Our Blog

Choosing the Right Business Entity for you!!!

I'm still amazed when I here my current and potential clients talk about receiving advice to pursue one entity over another. People, there are no one size fits all in this game. Some things will work for one person, if judging according to the law, that wont work for...

Income Tax Planning/Projection

Wondering if you'll be ready to meet this year's tax obligation or where you'll stand based upon current measures and prospects for the remainder of the year? This is a good time to do some Income Tax Planning/Projection. For Business Owners as well as Individuals....

Best Accounting Firm

Thank you Northwest County for Voting Us Best Accounting Firm! We'll continue to strive to provide Superior Services to Northwest County and Beyond!!!

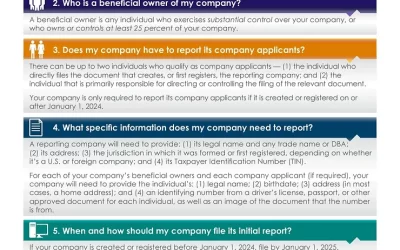

Beneficial Owners Reporting Requirement

New Reporting Requirement for Owners of LLC's or Small Corporations (Beneficial Owners). Reporting for Entities Established Prior to January 1, 2024, Due January 1, 2025. For those Established After January 1, 2024 Reporting Due within 30 days of Registration of...

Estate &/Or Succession Planning

Please be on the Lookout for New Tax Scams from Those Pretending to be the IRS

IRS, Security Summit partners warn taxpayers of new scam; unusual delivery service mailing tries to trick people into sending photos, bank account information IR-2023-123, July 3, 2023 WASHINGTON ― The Internal Revenue Service warned taxpayers today to be on the...

Reminder – 2nd Qt 2023 Estimates Due – June 15th

Hello Family! Just a reminder that 2nd Qt 2023 Estimates are due June 15th. Please pay or contact us to create/revise as needed. Thank you!

Special IRS Offer to Avoid Late File Penalty for 22

Issue Number: IR-2023-113 Inside This Issue Special options available to help taxpayers who missed the April deadline; people encouraged to file, pay by June 14 to avoid larger penalties and interest WASHINGTON — The Internal Revenue Service today encouraged...

Deadline Extended to File 2019 Tax Return – July 17, 2023

Residential Clean Energy Credit

Here's an awesome credit that will assist homeowners in reducing taxes: Taxpayers can also claim the Residential Clean Energy Credit for qualifying costs for either an existing home or a newly constructed home. Qualifying costs may include: Solar, wind and...